Building a betting empire from a Boston bedroom took more than luck for three friends chasing a dream. Institutional powerhouses now hold the reins, yet the original vision remains intact.

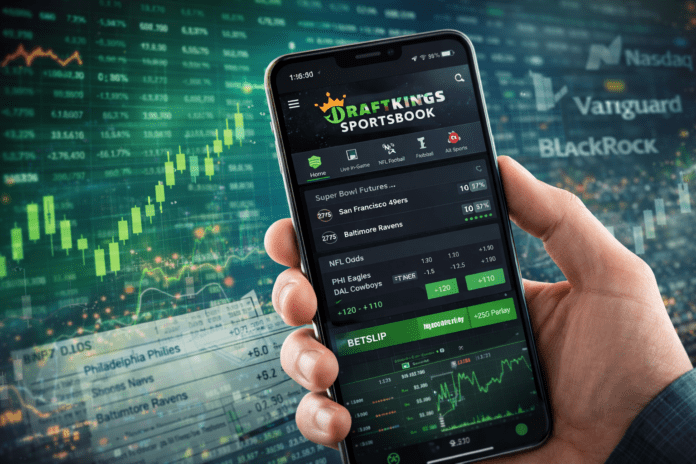

In 2012, three friends launched a project in a spare bedroom that eventually flipped the entire sports world upside down. Fans wanted something faster than traditional season-long leagues, so they built a platform for immediate results and instant dopamine hits. You likely recognize the brand now as a staple of the NASDAQ exchange under the ticker DKNG. Watching that ticker provides a window into a world where institutional giants hold the most influence. Founders still lead the daily operations despite the massive influx of Wall Street capital. Every sports bettor looking for an edge recognizes this name.

Trading under the ticker DKNG, DraftKings stock has become a closely watched barometer for the U.S. online betting industry. Share price swings often reflect regulatory developments, new state launches and quarterly earnings performance rather than just sportsbook handle alone.

DraftKings’ rise accelerated dramatically in 2020 when the company went public through a reverse merger with Diamond Eagle Acquisition Corp, a special purpose acquisition company (SPAC). That deal allowed DraftKings to list on the NASDAQ without a traditional IPO, injecting significant institutional capital and expanding its growth runway. The public listing marked the transition from fantasy startup to full-scale betting corporation.

Corporate Bench Members Pulling the Strings at DraftKings

Institutional investors currently own about 96% of the outstanding stock. Vanguard Group stands as the largest single shareholder with an ownership stake of approximately 8.9% as of early 2026. BlackRock follows with a holding near 5% while FMR LLC maintains a stake of around 4.4% according to recent SEC filings. Publicly traded companies often feel like faceless entities, yet your favorite sportsbook belongs to thousands of individuals.

Powerful financial managers in Boston and New York essentially influence the biggest decisions. Every move made by these institutional whales impacts the direction of your betting experience. Money flows through these massive funds to sustain the platform you use every day. Retail investors hold the remaining portion, giving smaller players a seat at the table. Seeing these names on the cap table tells you that the world’s most serious money managers are betting on long-term viability. Every investor is chasing a return.

DraftKings Fantasy Roots Growing into a Sportsbook Empire

Annual revenue reached $4.77 billion in 2024, which represented a 30% increase from the previous year. Many new users are getting attracted thanks to offers like the DraftKings sportsbook promo code, which helps them get a head start with the platform. Utilizing these incentives helps the company maintain a market share that hovered around 35% in late 2025. Trailing 12-month revenue hit $5.46 billion by September 2025.

Marketing and technological refinement keep those users active on the app. High-speed data processing ensures that live odds remain accurate during the most intense moments of a game. Converting those high revenue figures into long-term stability remains a focus for the current board. Every dollar spent on acquisition reflects their goal of total market dominance. Smaller rivals struggle to keep up with this level of spending. High-volume betting days during the football season provide the bulk of these massive earnings for the shareholders.

FanDuel remains DraftKings’ primary competitor in the U.S. market, with BetMGM, Caesars Sportsbook and ESPN BET also competing for national share. The battle for customer acquisition has driven aggressive promotional spending across the sector, shaping profitability timelines for all major operators.

Despite strong revenue growth, DraftKings has historically prioritized expansion over profitability. Heavy marketing spend, state entry costs and promotional incentives have delayed sustained net profit, though leadership continues signaling a long-term path toward positive earnings.

Public Ownership and Institutional Might

Jason Robins, Matthew Kalish, and Paul Liberman still represent the organization to the public. Robins serves as the CEO and Chairman, holding about 1% of the total economic interest. Voting power remains with the founders despite the heavy institutional presence. Board meetings in these financial hubs determine the broad strategies. Working together for over a decade has allowed them to anticipate what bettors want.

Maintaining a founder-led culture helps the brand stay agile compared to older gambling houses. You’re seeing the results of their specific focus every time the app updates with a new feature. People often overlook how their wagers contribute to a massive global machine. Leaders at the top ensure the platform stays competitive against rising rivals. Decisions made in those Boston offices impact your Sunday morning routine. Combining technical expertise with a deep love for sports keeps the founders at the center of the conversation.

Major DraftKings shareholders snapshot

Vanguard Group — ~8.9%

BlackRock — ~5%

FMR LLC — ~4.4%

Founders & executives — ~1% combined economic interest

Public & retail investors — Remaining float

Licensing and U.S. market access

DraftKings operates under state-by-state regulatory approvals across the United States. Each jurisdiction requires separate licensing, compliance audits and tax agreements. As of 2026, the sportsbook is live in most legalized betting states, including New Jersey, Pennsylvania, Michigan and Colorado, with continued expansion tied directly to legislative approvals.

February Betting Pulse Super Bowl LX and MLB Futures

Football fans are focusing on Levi’s Stadium as the NFL season reaches its climax on February 8, 2026. According to Covers, early betting lines for Super Bowl LX show significant movement as the Seahawks prepare to face the Patriots:

- Seattle Seahawks enter the game as 4.5-point favorites

- Seattle sits at -230 while the underdog Patriots offer a return of +195

- Bookmakers set the over/under at 45.5 points after early sharp action

Picking an outright winner involves looking at the moneyline, where Seattle remains the heavy favorite. Have you considered how the weather might impact the kicking game in California? Watching these numbers move provides a pretty clear window into how the experts view the matchup. Experts often look for value in these margins before the public floods the market on game day. Placing your bets early often secures better value.

MLB The Quest for a Dodgers Three-Peat

Baseball fans are already looking toward the spring as the Los Angeles Dodgers attempt a historic third consecutive title. Early odds place the Dodgers as the clear favorites at +260 to win the 2026 World Series. New York Yankees supporters see their team as the primary challenger in the American League, with odds sitting at +750. The Philadelphia Phillies sit at +1100 and the Seattle Mariners at +1200.

Analyzing these upcoming MLB odds requires a look at off-season roster changes and pitching rotations. High expectations surround the Dodgers, given their recent results and deep financial resources. Smaller market teams like the Mariners offer higher payouts for those willing to take a chance on an upset. Every win during spring training will likely cause these lines to adjust. Staying updated on player health remains a priority for anyone looking to lock in a championship bet. Tracking these futures allows fans to find early value before the season begins.

Innovation and Upcoming Tech at DraftKings

Adapting to new trends keeps this giant ahead of its competitors. Crypto-to-cash access is moving into four specific states as of February 2026. Purchasing companies like Railbird Technologies allowed them to get a foothold in prediction markets (a move that signals a broader tech strategy). Constant updates to features like parlays and live stat tracking keep users coming back to the app.

Prediction market technology allows users to trade contracts on real-world outcomes beyond traditional sports betting. DraftKings’ interest in this sector signals a strategic hedge into adjacent wagering formats that could expand user engagement beyond game-day betting.

Finding ways to integrate social features also helps keep the community active on the platform. Engineers work daily to refine the user experience. Calculated moves like these help maintain their massive revenue figures as the market matures. Every move is tracked by observers.

Frequently asked questions

Who is the largest shareholder of DraftKings?

Institutional investors collectively own the majority, with Vanguard Group holding the largest individual stake.

Is DraftKings a publicly traded company?

Yes. DraftKings trades on the NASDAQ under the ticker DKNG.

Do the founders still run DraftKings?

Yes. CEO Jason Robins and co-founders remain actively involved in company leadership and strategy.

Ownership structure shapes far more than boardroom decisions. Institutional capital funds expansion, technology upgrades and promotional firepower that directly influence the betting experience users see on their screens.

Understanding who owns DraftKings isn’t just a finance exercise. It provides insight into how the platform grows, innovates and competes — and why it remains one of the dominant forces in modern sports wagering.