Betting has become a part of daily life for many. It evolved from early horse races in the 18th century to its widespread use in sports betting apps. As betting has become normalized, its financial impact on individuals has grown.

The betting boom began after 2018. The year the Supreme Court struck down the law that prohibited sports gambling.

More than 50% of Americans placed bets at least once last year. The percentage is still rising. It also revealed that Americans believe that the gaming industry has a good impact on the U.S. economy.

But what about their personal financial well-being?

With ‘responsible’ betting, it might seem harmless. But it becomes difficult to keep oneself in check when there’s a constant temptation to push one’s luck.

How does continuous betting drain accounts? Does it lead to poor choices and jeopardize your finances and mental well-being? Let’s take a closer look.

Who’s Placing The Bets?

People aged 25-34 represent the largest demographic of active bettors. In January 2025, the survey analyzed which users were the most active.

It shows that the number of men using those is bigger than the number of women. Actually, the top three sports for betting are soccer, basketball, and American football.

Higher Stakes, Easy Access

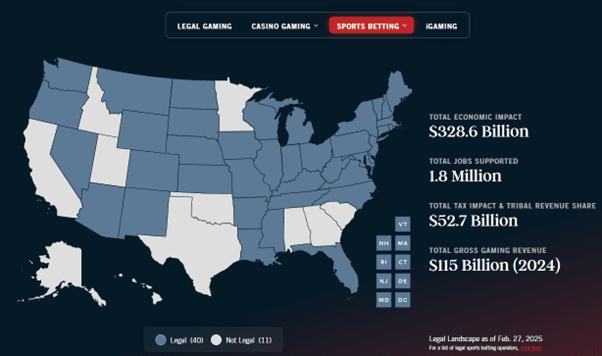

Nevada was the first state to permit gambling and betting. By 2024, according to Statista, 38 states legalized sports betting. There were various lawsuits and court procedures along the way. As a result, people gained what they fought for: the right to make their own choice.

“A great day for the rights of states and their people to make their own decisions. New Jersey citizens wanted sports gambling, and the federal Gov’t had no right to tell them no. The Supreme Court agrees with us today. I am proud to have fought for the rights of the people of NJ,” says Chris Christie, American politician and lawyer.

Of course, the Court’s decision was not the only reason that boosted the betting boom. Betting apps’ accessibility and convenience played a key role. Before, people would go to the closest physical sportsbook to make a bet. Now, betting is faster and more convenient. It also happens with a level of anonymity that wasn’t possible before. No one sees when or where you’re placing bets.

Since legalization in 2018, betting revenue has risen. It almost reached $310M in June 2018 and more than $13M in November 2025. To note, it hit its highest point in October 2025 (more than $16M).

With well-designed apps, modern betting platforms made people start betting and stay engaged:

- One-click deposits coming from bank accounts.

- Live in-game betting opens up new betting opportunities every minute.

- Push notifications as reminders of upcoming games and promotional offers.

- Parlay builders that make complex bets feel simple and exciting.

Do not forget about celebrities’ influence and advertising campaigns, which increase total revenue. Marketing makes it seem ‘easy’ and ‘risk-free’ for bettors. But very often it leads to betting addiction in the future.

Small Bets Adding Up To Big Losses

‘Small bet’ sounds very attractive, and the marketers know that. That’s why it feels like not losing anything by betting a small amount of money. Bettors are promised to invest less but get more quickly and withdraw more cash. As a result, bettors continue putting down more and more, unaware of the hidden dangers it entails.

Still, marketers succeed at making bettors invest because they know that:

- Small bets create an illusion of control;

- They’re perceived as something ‘safe’;

- The fantasy of ‘winning’;

- Fast feedback on the ‘progress’;

- People remain unaware of cumulative risk over the long term;

- Luxurious association of the design of the apps and platforms;

- Something considered ‘fun’ and ‘lucky’ doesn’t seem likely to have bad outcomes in the future.

Once a person tries to see how lucky they are, they become a target for marketers. Platforms and apps feed their desire to see whether they can be luckier next time. According to Business Insider, many businesses wonder what else people can bet on. So it’s a never-ending cycle.

Consider these statistics. The Daily Mail found that Americans alone have lost around $245B since 2018. Here, the ‘big win effect’ occurs. Once bettors win any amount of money, they next increase their bet. Engaging in sports betting undermines financial stability and decision-making, leading to worse outcomes.

The Shift From Fun To Financial Troubles

Sports betting is a huge issue. There has been extensive research and discussion about the dangers of betting. Sometimes it is very hard to see when it’s starting to feel like an addiction.

The Pew Research Center had a survey on sports betting and its impact on American society. Almost 50% of people stated that it’s bad for society, even though it’s legal, proving the point.

The money once spent on groceries, rent, utilities, or other expenses is now for ‘future wins’. A different story is when the bettor has a household and a family. In this case, the victims are actually everyone. In this case, households undergo serious limits and changes:

- New credit card debts that people find hard to repay;

- Borrowing money from everywhere possible;

- Late or delayed bill payment and financial instability;

- Skipped bills as a result of betting addiction;

- Constant anxiety and stress;

- Using different cards and payment methods that add up to debt;

- Tension in a family and financial stress.

It’s a dopamine hit that does not last long and actually leads to more financial troubles. It also jeopardizes the relationships and trust between close ones.

With late payments come long-term consequences. Delayed payments lower credit scores, and credit reports don’t make the situation easier. The score that took so much time to build is at risk because of a small bet that caused financial issues.

What Is At Risk?

The damage is real, the score drop from 750 to 630 may not seem like a big deal. It involves real financial losses and changes one’s financial situation and well-being. In this case, the interest rate will rise, for example, it could go from 4% up to 12%. One must overpay the extra cost. Low credit scores not only hurt your borrowing power. It also affects apartment applications, insurance premiums, and job opportunities in certain fields.

Poor credit makes financial recovery much harder and more expensive. The cycle where you pay more for everything while having less money to work with. These financial troubles in the long term also affect your future:

- No retirement investments. Even a small amount of savings can make a significant sum in the future. For example, saving $250 that will grow to $560,000 with time.

- Heavy taxing. Every sum of money won is still taxable, especially when income is not reported. This leads to various audits, penalties, and interest on one’s legal activities.

- The savings one worked on for so many years vanish. Some report losing valuable assets, including vehicles and even homes.

These consequences do not happen overnight. It starts small but often leads to bankruptcy attorneys, financial advisors, and creditors. Usually, it’s a repetitive cycle that is hard to break.

Is It Possible To Change The Situation?

Shania Brenson is the co-founder and financial expert at 15M Finance. She worked at American National Bank of Texas and understands the core of the issue and how to fix it. It is a mix of financial and psychological factors. What can you do first to break the cycle? Delete betting apps, close accounts, and unsubscribe from promotional emails and app notifications. There is also a financial solution that improves the situation.

“At 15M, we see people with regular sports betting. It led to financial problems,” Brenson told Yahoo Finance. “The issue is rarely a single loss. It’s a cumulative effect of repeated betting over time. A lot of people don’t realize how much their spending has become a financial burden. It continues so until facing credit card issues or completely depleted savings accounts.”

Struggling with debt is stressful, and it calls for action. For those who want to change their situation, there is a solution: payday loans. Such loans can cover necessary expenses while one focuses on long-term finances. It can be a hard time for bettors and their loved ones, but taking the first step makes it all better with time.

With her team, Shania helps bettors get back on track and regain financial stability. According to her experience, payday loans are part of taking control back.

“People reach out to us in crisis situations. It’s usually unexpected car repairs, medical bills, or sometimes gambling debt. We encourage everyone to work with financial counselors and address the real issue. Not only the symptoms. What matters most is what happens next. Are they using this as a one-time bridge while making real changes, or are they creating a cycle? ”

Shania says people shouldn’t use payday loans for future betting. However, they can help you bridge short-term money gaps. But here’s the thing. This only makes sense if one can actually pay it back on time. Borrowing without knowing how to repay it creates another debt cycle.

One can catch up on overdue bills, pay off high-interest credit cards, and build a credit score. Payday loans can open the door to financial stability. Finally, set credit goals, reach them in the future, and rebuild trust with the ones closest to you.

Pay attention to not relapsing into betting. Work with a trustworthy financial counselor instead. Putting effort in is crucial. It may seem hard, but it’s doable.

15M Finance provides guidance on managing debt from sports betting and rebuilding your finances. Reach Shania Brenson and the team at the email address info@15mfinance.com or call (737) 241-3988.